Here's a bit of re-writing of code that may make the notation of S more intuitive and will allow you to inspect your answer for reasonableness.

Initial points:

- In your code, the second

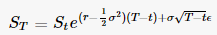

deltat should be replaced by np.sqrt(deltat). Source here (yes, I know it's not the most official, but results below should be reassuring).

- The comment regarding un-annualizing your short rate and sigma values may be incorrect. This has nothing to do with the downward drift you're seeing. You need to keep these at annualized rates. These will always be continuously compounded (constant) rates.

First, here is a GBM-path generating function from Yves Hilpisch - Python for Finance, chapter 11. The parameters are explained in the link but the setup is very similar to yours.

![enter image description here]()

def gen_paths(S0, r, sigma, T, M, I):

dt = float(T) / M

paths = np.zeros((M + 1, I), np.float64)

paths[0] = S0

for t in range(1, M + 1):

rand = np.random.standard_normal(I)

paths[t] = paths[t - 1] * np.exp((r - 0.5 * sigma ** 2) * dt +

sigma * np.sqrt(dt) * rand)

return paths

Setting your initial values (but using N=252, number of trading days in 1 year, as the number of time increments):

S0 = 100.

K = 100.

r = 0.05

sigma = 0.50

T = 1

N = 252

deltat = T / N

i = 1000

discount_factor = np.exp(-r * T)

Then generate the paths:

np.random.seed(123)

paths = gen_paths(S0, r, sigma, T, N, i)

Now, to inspect: paths[-1] gets you the ending St values, at expiration:

np.average(paths[-1])

Out[44]: 104.47389541107971

The payoff, as you have now, will be the max of (St - K, 0):

CallPayoffAverage = np.average(np.maximum(0, paths[-1] - K))

CallPayoff = discount_factor * CallPayoffAverage

print(CallPayoff)

20.9973601515

If you plot these paths (easy to just use pd.DataFrame(paths).plot(), you'll see that they're no longer downward-trending but that the Sts are approximately log-normally distributed.

Lastly, here's a sanity check through BSM:

class Option(object):

"""Compute European option value, greeks, and implied volatility.

Parameters

==========

S0 : int or float

initial asset value

K : int or float

strike

T : int or float

time to expiration as a fraction of one year

r : int or float

continuously compounded risk free rate, annualized

sigma : int or float

continuously compounded standard deviation of returns

kind : str, {'call', 'put'}, default 'call'

type of option

Resources

=========

http://www.thomasho.com/mainpages/?download=&act=model&file=256

"""

def __init__(self, S0, K, T, r, sigma, kind='call'):

if kind.istitle():

kind = kind.lower()

if kind not in ['call', 'put']:

raise ValueError('Option type must be \'call\' or \'put\'')

self.kind = kind

self.S0 = S0

self.K = K

self.T = T

self.r = r

self.sigma = sigma

self.d1 = ((np.log(self.S0 / self.K)

+ (self.r + 0.5 * self.sigma ** 2) * self.T)

/ (self.sigma * np.sqrt(self.T)))

self.d2 = ((np.log(self.S0 / self.K)

+ (self.r - 0.5 * self.sigma ** 2) * self.T)

/ (self.sigma * np.sqrt(self.T)))

# Several greeks use negated terms dependent on option type

# For example, delta of call is N(d1) and delta put is N(d1) - 1

self.sub = {'call' : [0, 1, -1], 'put' : [-1, -1, 1]}

def value(self):

"""Compute option value."""

return (self.sub[self.kind][1] * self.S0

* norm.cdf(self.sub[self.kind][1] * self.d1, 0.0, 1.0)

+ self.sub[self.kind][2] * self.K * np.exp(-self.r * self.T)

* norm.cdf(self.sub[self.kind][1] * self.d2, 0.0, 1.0))

option.value()

Out[58]: 21.792604212866848

Using higher values for i in your GBM setup should cause closer convergence.