I am trying to use CopyRates() to search for a bullish engulfing candlestick pattern (bearish candle followed by a bigger bullish candle) on several timeframes (all timeframes H2 to M10 within an H4 bullish candle after it closes). I read the definition of CopyRates() but I'm finding it a bit challenging to implement. The idea here is from the patterns I want to filter the pattern that has the biggest bearish to bullish candle pair ratio. See what I've done so far below:

In the OnTick():

for (int i=ArraySize(timeframes); i>=1; i--) {

if(CopyRates(Symbol(), timeframes[i - 1], 1, MyPeriod, rates)!=MyPeriod) {

Print("Error CopyRates errcode = ",GetLastError());

return;

}

// Using bullish engulfing pattern:

if ((rates[numCandle].open < rates[numCandle].close) &&

(rates[numCandle + 1].open > rates[numCandle + 1].close) &&

(rates[numCandle + 1].open < rates[numCandle].close) &&

(rates[numCandle + 1].close > rates[numCandle].open)) {

// Not too certain what should be done here

}

}

Here's the other related code:

input int numCandle=0;

MqlRates rates[];

ENUM_TIMEFRAMES timeframes[7] = {PERIOD_H2, PERIOD_H1, PERIOD_M30, PERIOD_M20, PERIOD_M15, PERIOD_M12, PERIOD_M10};

void OnInit() {

ArraySetAsSeries(rates, true);

}

UPDATED

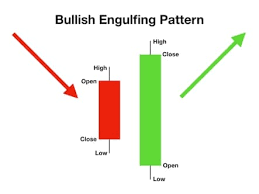

Below is the definition of the bullish engulfing pattern:

The bullish engulfing pattern as shown in the above image is a bearish candle followed by a bullish candle. The bearish candle’s open less than the bullish candle’s close and the bearish candle’s close is greater than the bullish candle’s open. Please note that in several cases, the bearish candle's close is greater than the bullish candle's open by only a fraction. Each of the candles has a body size bigger than it’s upper and lower wicks combined.