Some ideas & guidances:

Based on your statement (cit.:)

I did some searches and thought for a whole day, there is no a really good idea on how to do.

I can make you sure, there is no universally good idea, how to solve this, but this should not make you nervous. Generations of CTAs have spent their whole lives on doing this to their individual horizons of the best efforts they could have spent on mastering this, so at least, we can learn on what they have left us as a path to follow.

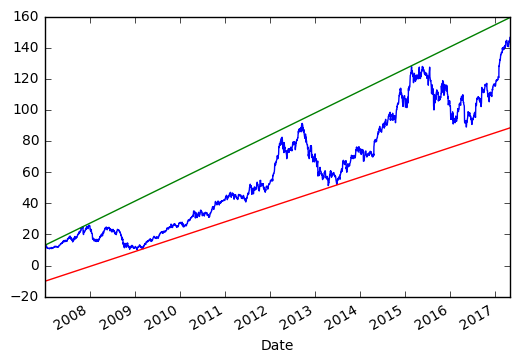

![Trend is more an OPINION than a somewhat calculus-based line]()

1) DEFINE a Trend:

As an initial surprise, one ought consider a trend to be rather an exosystem-driven ( extrinsic ) feature, which is more related to an opinion, than to a TimeSeries Data ( observable ) history.

In other words, once one realises, that the information about a trend is simply not present internally in the TimeSeries dataset, the things will start to clear up significantly.

2) given one believes strong enough into her/his Trend-identification methods,

one can but EXTEND such Trend-indication, as a line-of-belief, into FUTURE ( a conjecture )

3) The MARKET & only The Market VALIDATES ( or ignores ) such one's "accepted"-belief.

4) SHARED beliefs RE-CONFIRM such a line-of-belief as a majority respected Trend-indication ( measured by Market risk exposed equity, not by a popular vote, the less by crowd-shouted or CTAs' self-promoting squeeks )

Does it ever work?

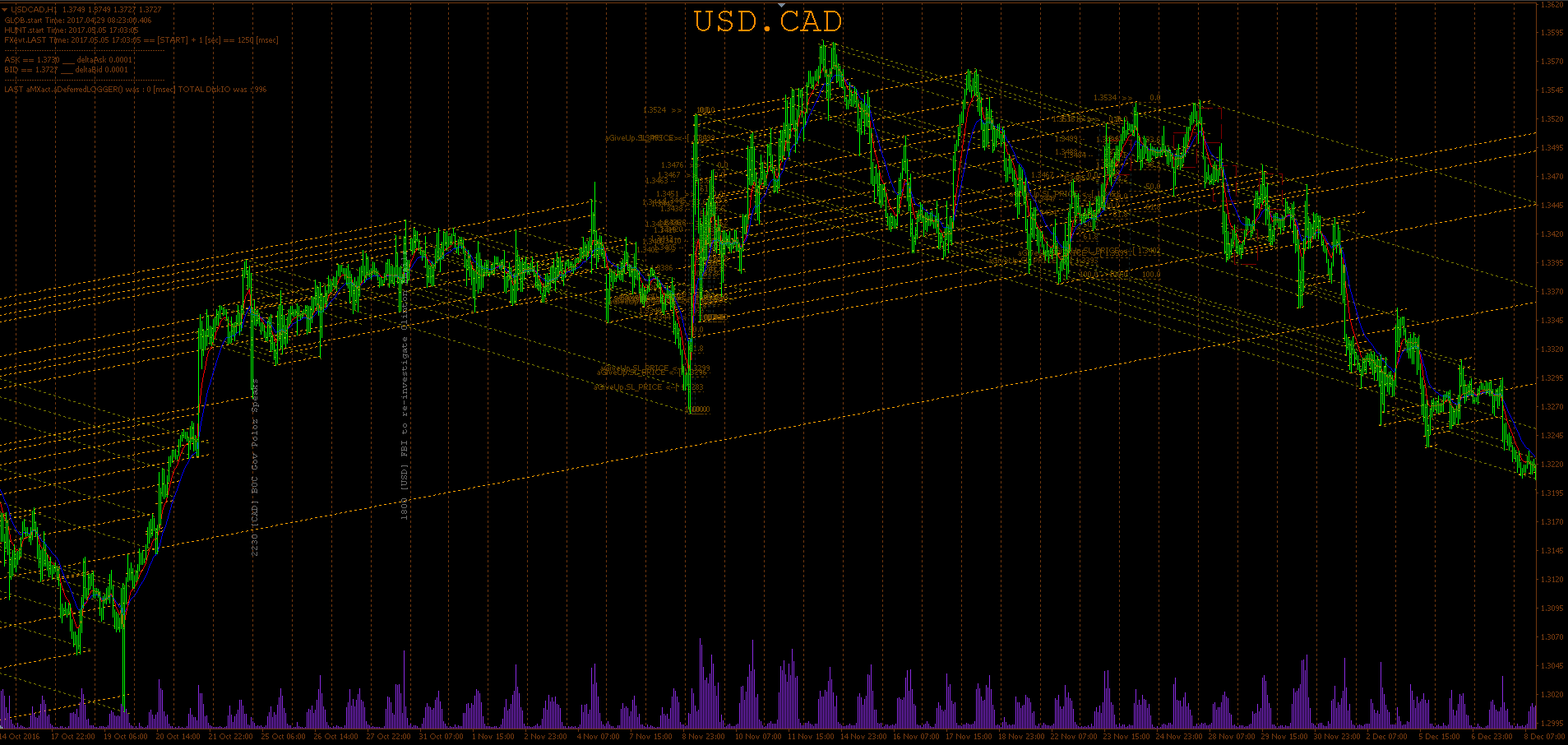

The USDCAD example screen above ( zoom-out into a new window for a full-scale indepth view ) reflects all these, plus adds a few instances of FUNDAMENTAL EVENT, that were introduced "across" the technically drafted ( quantitatively supported ) principal attractors, showing a part of a real life of the flow of the river called an FX-trading.

pandas_talib(the package) – Sarrusophone