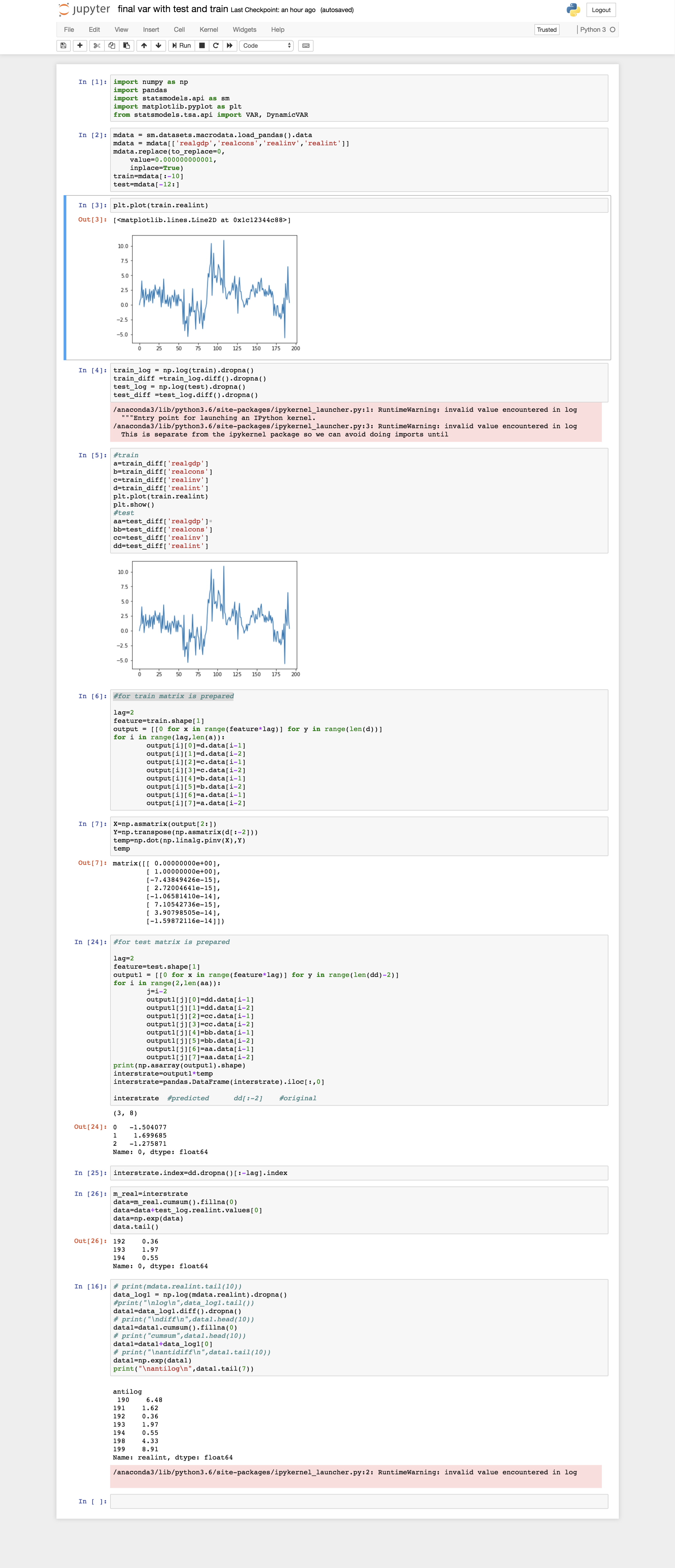

I followed the statsmodel tutorial on VAR models and have a question about the results I obtain (my entire code can be found at the end of this post).

The original data (stored in mdata)is clearly non-stationary and therefore needs to be transformed which is done using the line:

data = np.log(mdata).diff().dropna()

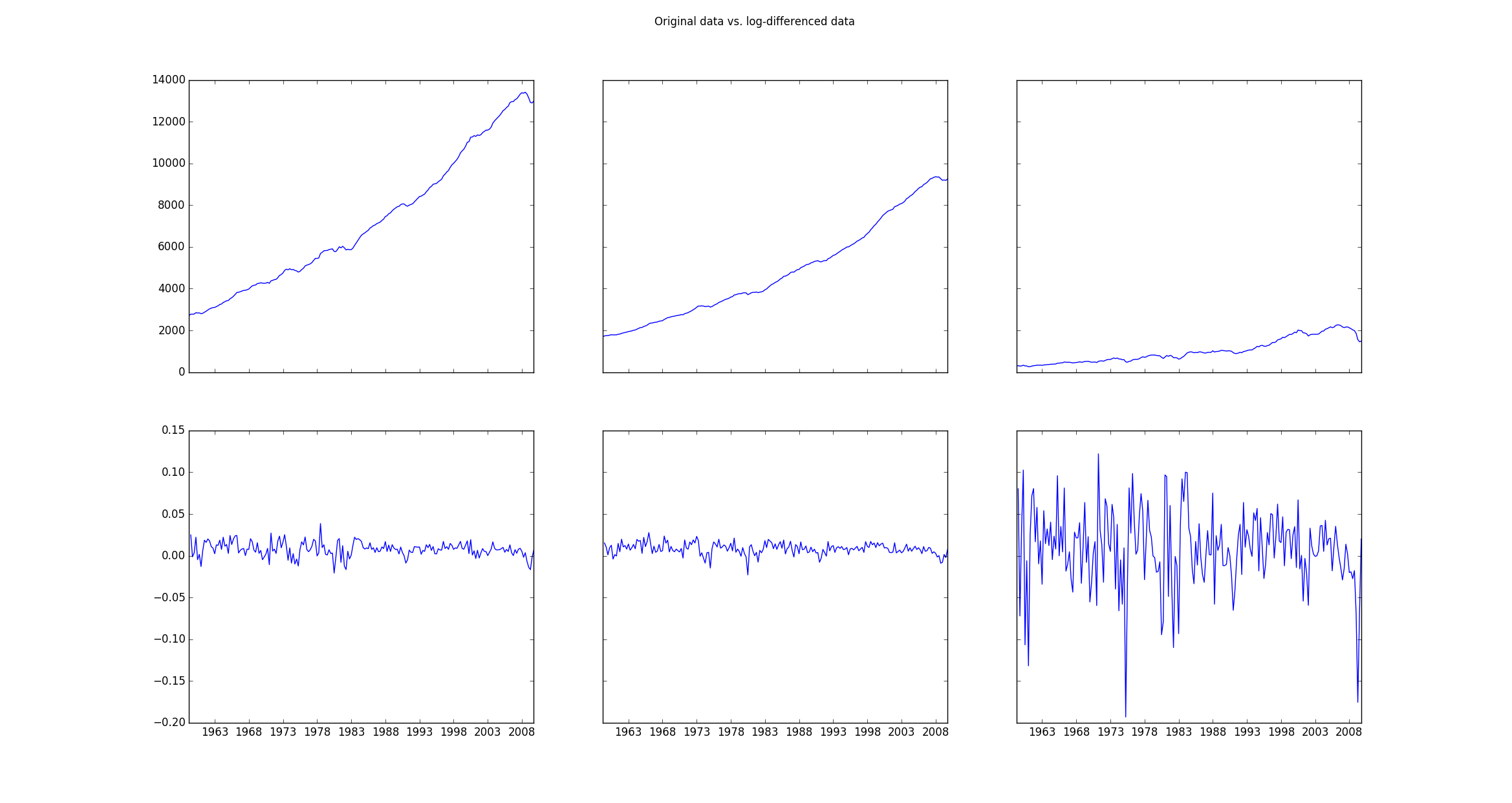

If one then plots the original data (mdata) and the transformed data (data) the plot looks as follows:

Then one fits the log-differenced data using

model = VAR(data)

results = model.fit(2)

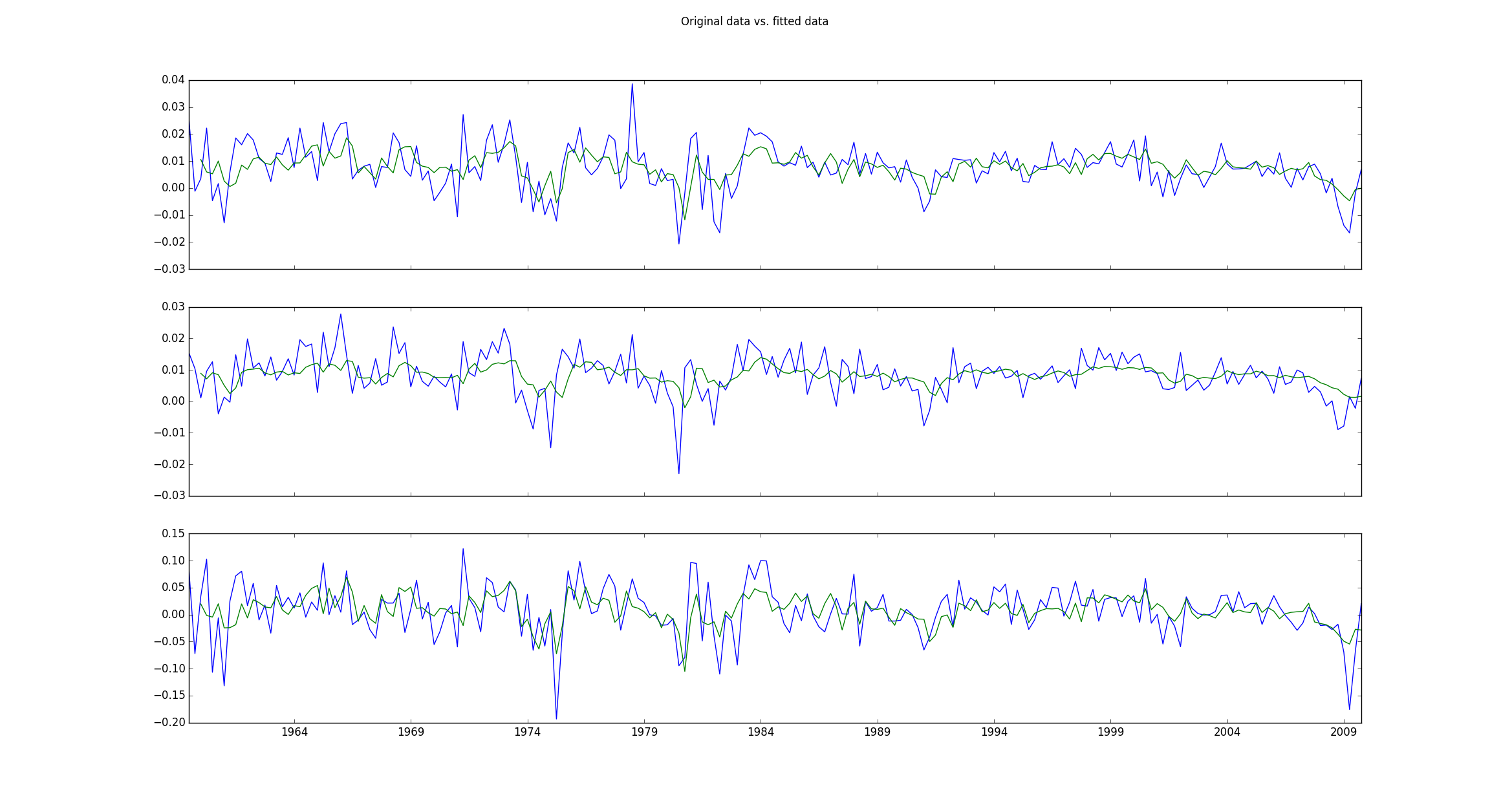

If I then plot the original log-differenced data vs. the fitted values, I get a plot like this:

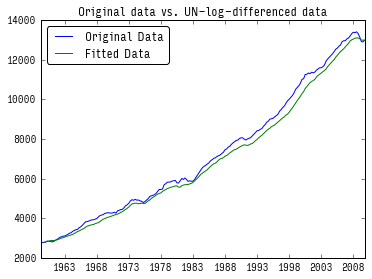

My question is how I can get the same plot but for the original data which are not log-differenced. How can I apply the parameters determined by the fitting values to the these original data? Is there a way to transform the fitted log-differenced data back to the original data using the parameters I obtained and if so, how can this be accomplished?

Here is my entire code and the output I obtain:

import pandas

import statsmodels as sm

from statsmodels.tsa.api import VAR

from statsmodels.tsa.base.datetools import dates_from_str

from statsmodels.tsa.stattools import adfuller

import numpy as np

import matplotlib.pyplot as plt

mdata = sm.datasets.macrodata.load_pandas().data

dates = mdata[['year', 'quarter']].astype(int).astype(str)

quarterly = dates["year"] + "Q" + dates["quarter"]

quarterly = dates_from_str(quarterly)

mdata = mdata[['realgdp', 'realcons', 'realinv']]

mdata.index = pandas.DatetimeIndex(quarterly)

data = np.log(mdata).diff().dropna()

f, ((ax1, ax2, ax3), (ax4, ax5, ax6)) = plt.subplots(2, 3, sharex='col', sharey='row')

ax1.plot(mdata.index, mdata['realgdp'])

ax2.plot(mdata.index, mdata['realcons'])

ax3.plot(mdata.index, mdata['realinv'])

ax4.plot(data.index, data['realgdp'])

ax5.plot(data.index, data['realcons'])

ax6.plot(data.index, data['realinv'])

f.suptitle('Original data vs. log-differenced data ')

plt.show()

print adfuller(mdata['realgdp'])

print adfuller(data['realgdp'])

# make a VAR model

model = VAR(data)

results = model.fit(2)

print results.summary()

# results.plot()

# plt.show()

f, axarr = plt.subplots(3, sharex=True)

axarr[0].plot(data.index, data['realgdp'])

axarr[0].plot(results.fittedvalues.index, results.fittedvalues['realgdp'])

axarr[1].plot(data.index, data['realcons'])

axarr[1].plot(results.fittedvalues.index, results.fittedvalues['realcons'])

axarr[2].plot(data.index, data['realinv'])

axarr[2].plot(results.fittedvalues.index, results.fittedvalues['realinv'])

f.suptitle('Original data vs. fitted data ')

plt.show()

which gives the following output:

(1.7504627967647102, 0.99824553723350318, 12, 190, {'5%': -2.8768752281673717, '1%': -3.4652439354133255, '10%': -2.5749446537396121}, 2034.5171236683821)

(-6.9728713472162127, 8.5750958448994759e-10, 1, 200, {'5%': -2.876102355, '1%': -3.4634760791249999, '10%': -2.574532225}, -1261.4401395993809)

Summary of Regression Results

==================================

Model: VAR

Method: OLS

Date: Wed, 09, Mar, 2016

Time: 15:08:07

--------------------------------------------------------------------

No. of Equations: 3.00000 BIC: -27.5830

Nobs: 200.000 HQIC: -27.7892

Log likelihood: 1962.57 FPE: 7.42129e-13

AIC: -27.9293 Det(Omega_mle): 6.69358e-13

--------------------------------------------------------------------

Results for equation realgdp

==============================================================================

coefficient std. error t-stat prob

------------------------------------------------------------------------------

const 0.001527 0.001119 1.365 0.174

L1.realgdp -0.279435 0.169663 -1.647 0.101

L1.realcons 0.675016 0.131285 5.142 0.000

L1.realinv 0.033219 0.026194 1.268 0.206

L2.realgdp 0.008221 0.173522 0.047 0.962

L2.realcons 0.290458 0.145904 1.991 0.048

L2.realinv -0.007321 0.025786 -0.284 0.777

==============================================================================

Results for equation realcons

==============================================================================

coefficient std. error t-stat prob

------------------------------------------------------------------------------

const 0.005460 0.000969 5.634 0.000

L1.realgdp -0.100468 0.146924 -0.684 0.495

L1.realcons 0.268640 0.113690 2.363 0.019

L1.realinv 0.025739 0.022683 1.135 0.258

L2.realgdp -0.123174 0.150267 -0.820 0.413

L2.realcons 0.232499 0.126350 1.840 0.067

L2.realinv 0.023504 0.022330 1.053 0.294

==============================================================================

Results for equation realinv

==============================================================================

coefficient std. error t-stat prob

------------------------------------------------------------------------------

const -0.023903 0.005863 -4.077 0.000

L1.realgdp -1.970974 0.888892 -2.217 0.028

L1.realcons 4.414162 0.687825 6.418 0.000

L1.realinv 0.225479 0.137234 1.643 0.102

L2.realgdp 0.380786 0.909114 0.419 0.676

L2.realcons 0.800281 0.764416 1.047 0.296

L2.realinv -0.124079 0.135098 -0.918 0.360

==============================================================================

Correlation matrix of residuals

realgdp realcons realinv

realgdp 1.000000 0.603316 0.750722

realcons 0.603316 1.000000 0.131951

realinv 0.750722 0.131951 1.000000

realgdpI obtainL1.realcons=0.675016andL1.realgdp=-0.279435. What exactly does that tell me? Can one interpret these coefficients somehow as something similar like correlation coefficients? How would one express this relationship verbally? – Volpe