I have a .csv file containing a 5-year time series, with hourly resolution (commoditiy price). Based on the historical data, I want to create a forecast of the prices for the 6th year.

I have read a couple of articles on the www about these type of procedures, and I basically based my code on the code posted there, since my knowledge in both Python (especially statsmodels) and statistic is at most limited.

Those are the links, for those who are interested:

http://www.seanabu.com/2016/03/22/time-series-seasonal-ARIMA-model-in-python/

http://www.johnwittenauer.net/a-simple-time-series-analysis-of-the-sp-500-index/

First of all, here is a sample of the .csv file. Data is displayed with monthly resolution in this case, it is not real data, just randomly choosen numbers to give an example here (in which case I hope one year is enough to be able to develop a forecast for the 2nd year; if not, full csv file is available):

Price

2011-01-31 32.21

2011-02-28 28.32

2011-03-31 27.12

2011-04-30 29.56

2011-05-31 31.98

2011-06-30 26.25

2011-07-31 24.75

2011-08-31 25.56

2011-09-30 26.68

2011-10-31 29.12

2011-11-30 33.87

2011-12-31 35.45

My current progress is as follows:

After reading the input file and setting the date column as datetime index, the follwing script was used to develop a forecast for the available data

model = sm.tsa.ARIMA(df['Price'].iloc[1:], order=(1, 0, 0))

results = model.fit(disp=-1)

df['Forecast'] = results.fittedvalues

df[['Price', 'Forecast']].plot(figsize=(16, 12))

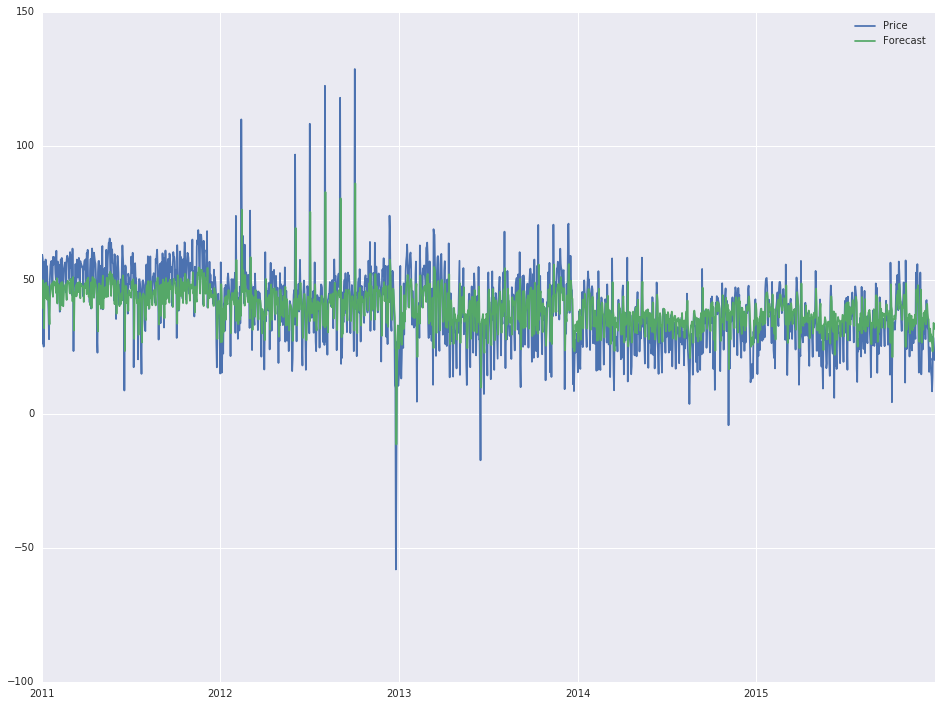

,which gives the following output:

Now, as I said, I ain't got no statistic skills and I have little to no idea how I got to this output (basically, changing the order attribute inside the first line changes the output), but the 'actual' forecast looks quite good and I would like to extend it for another year (2016).

In order to do that, additional rows are created in the dataframe, as follows:

start = datetime.datetime.strptime("2016-01-01", "%Y-%m-%d")

date_list = pd.date_range('2016-01-01', freq='1D', periods=366)

future = pd.DataFrame(index=date_list, columns= df.columns)

data = pd.concat([df, future])

Finally, when I use the .predict function of statsmodels:

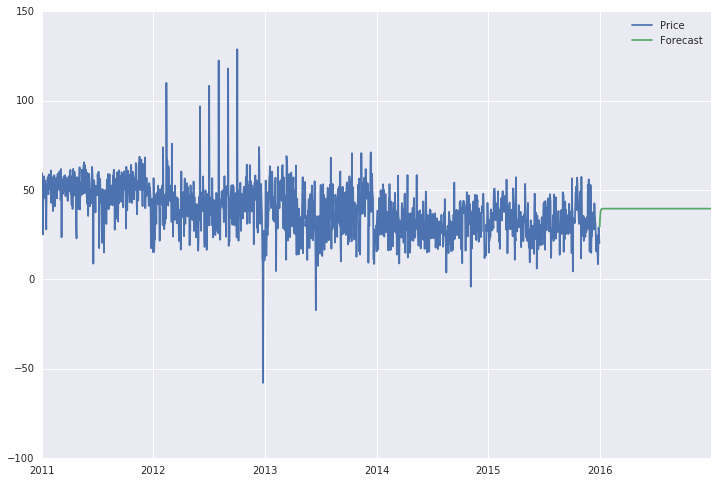

data['Forecast'] = results.predict(start = 1825, end = 2192, dynamic= True)

data[['Price', 'Forecast']].plot(figsize=(12, 8))

what I get as forecast is a straight line (see below), which doesn't seem at all like a forecast. Moreover, if I extend the range, which now is from the 1825th to 2192nd day (year of 2016), to the whole 6 year timespan, the forecast line is a straight line for the entire period (2011-2016).

I have also tried to use the 'statsmodels.tsa.statespace.sarimax.SARIMAX.predict' method, which accounts for a seasonal variation (which makes sense in this case), but I get some error about 'module' has no attribute 'SARIMAX'. But this is secondary problem, will get into more detail if needed.

Somewhere I am losing grip and I have no idea where. Thanks for reading. Cheers!