PLEASE NOTE: This question was successfully answered ptrj below. I have also written a blog post on my blog about my experiences with zipline which you can find here: https://financialzipline.wordpress.com

I'm based in South Africa and I'm trying to load South African shares into a dataframe so that it will feed zipline with share price information. Let's say I'm looking at AdCorp Holdings Limited as listed on the JSE (Johannesburg Stock Exchange):

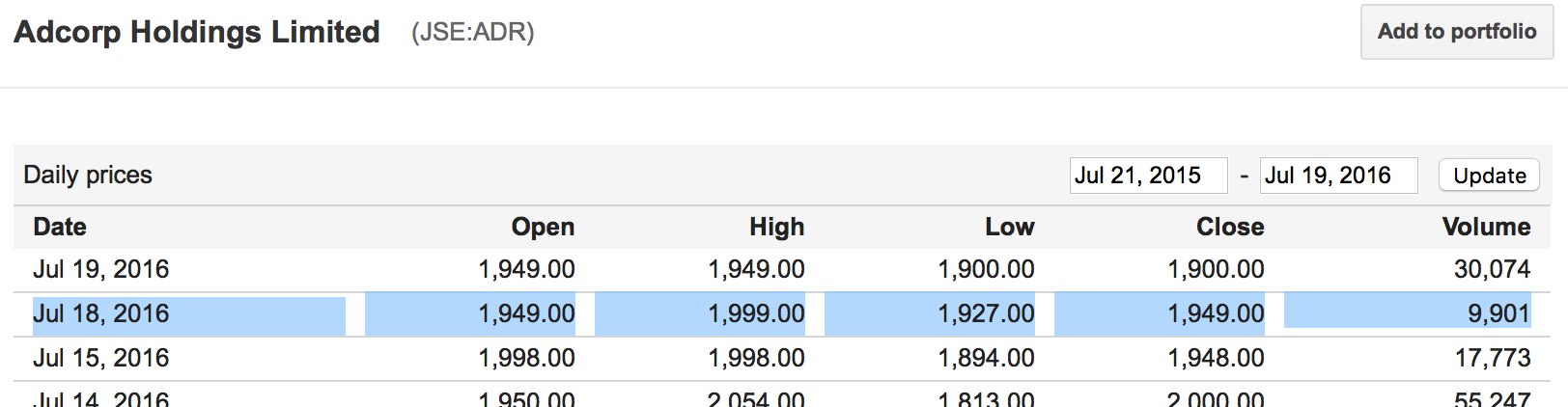

Google Finance gives me the historical price info:

https://www.google.com/finance/historical?q=JSE%3AADR&ei=5G6OV4ibBIi8UcP-nfgB

Yahoo Finance has no information on the company.

https://finance.yahoo.com/quote/adcorp?ltr=1

Typing in the following code within iPython Notebook gets me the dataframe for the information from Google Finance:

start = datetime.datetime(2016,7,1)

end = datetime.datetime(2016,7,18)

f = web.DataReader('JSE:ADR', 'google',start,end)

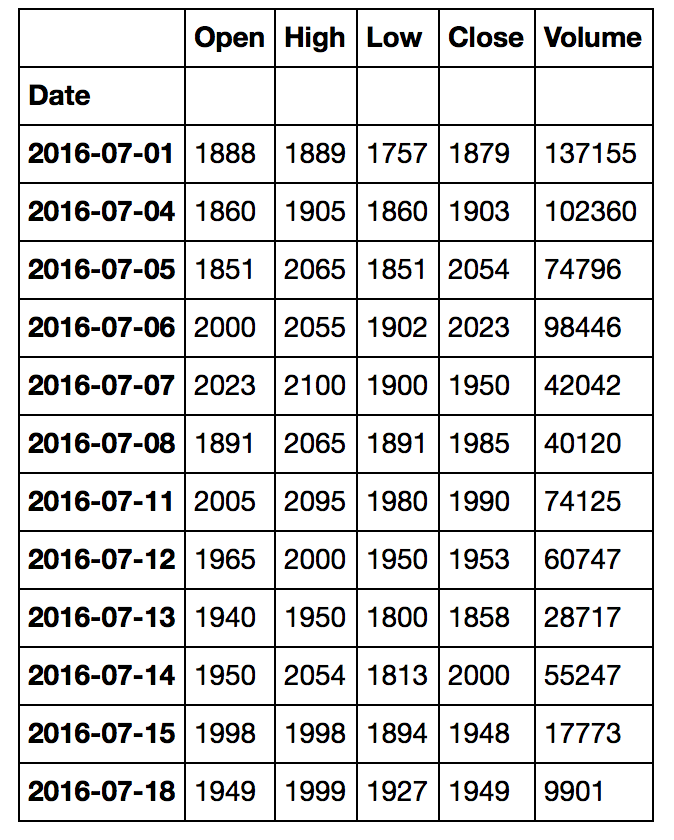

If I display f, I see that the information actually corresponds to the info off Google Finance as well:

This is the price exactly off Google Finance, you can see the info for the 2016-07-18 on the Google Finance website matches exactly to my dataframe.

However, I'm not sure how to load this dataframe so that it can be used by zipline as a data bundle.

If you look at the example given for buyapple.py, you can see that it just pulls the data of apple shares (APPL) from the ingested data bundle quantopian-quandl. The challenge here is to replace APPL with JSE:ADR so that it will order 10 JSE:ADR shares a day as fed from the dataframe instead of the data bundle quantopian-quandl and plot it on a graph.

Does anyone know how to do this? There are almost no examples on the net that deals with this...

This is the buyapple.py code as supplied in zipline's example folder:

from zipline.api import order, record, symbol

def initialize(context):

pass

def handle_data(context, data):

order(symbol('AAPL'), 10)

record(AAPL=data.current(symbol('AAPL'), 'price'))

# Note: this function can be removed if running

# this algorithm on quantopian.com

def analyze(context=None, results=None):

import matplotlib.pyplot as plt

# Plot the portfolio and asset data.

ax1 = plt.subplot(211)

results.portfolio_value.plot(ax=ax1)

ax1.set_ylabel('Portfolio value (USD)')

ax2 = plt.subplot(212, sharex=ax1)

results.AAPL.plot(ax=ax2)

ax2.set_ylabel('AAPL price (USD)')

# Show the plot.

plt.gcf().set_size_inches(18, 8)

plt.show()

def _test_args():

"""Extra arguments to use when zipline's automated tests run this example.

"""

import pandas as pd

return {

'start': pd.Timestamp('2014-01-01', tz='utc'),

'end': pd.Timestamp('2014-11-01', tz='utc'),

}

EDIT:

I looked at the code for ingesting the data from Yahoo Finance and modified it a little to make it take on Google Finance data. The code for the Yahoo Finance can be found here: http://www.zipline.io/_modules/zipline/data/bundles/yahoo.html.

This is my code to ingest Google Finance - sadly it is not working. Can someone more fluent in python assist me?:

import os

import numpy as np

import pandas as pd

from pandas_datareader.data import DataReader

import requests

from zipline.utils.cli import maybe_show_progress

def _cachpath(symbol, type_):

return '-'.join((symbol.replace(os.path.sep, '_'), type_))

def google_equities(symbols, start=None, end=None):

"""Create a data bundle ingest function from a set of symbols loaded from

yahoo.

Parameters

----------

symbols : iterable[str]

The ticker symbols to load data for.

start : datetime, optional

The start date to query for. By default this pulls the full history

for the calendar.

end : datetime, optional

The end date to query for. By default this pulls the full history

for the calendar.

Returns

-------

ingest : callable

The bundle ingest function for the given set of symbols.

Examples

--------

This code should be added to ~/.zipline/extension.py

.. code-block:: python

from zipline.data.bundles import yahoo_equities, register

symbols = (

'AAPL',

'IBM',

'MSFT',

)

register('my_bundle', yahoo_equities(symbols))

Notes

-----

The sids for each symbol will be the index into the symbols sequence.

"""

# strict this in memory so that we can reiterate over it

symbols = tuple(symbols)

def ingest(environ,

asset_db_writer,

minute_bar_writer, # unused

daily_bar_writer,

adjustment_writer,

calendar,

cache,

show_progress,

output_dir,

# pass these as defaults to make them 'nonlocal' in py2

start=start,

end=end):

if start is None:

start = calendar[0]

if end is None:

end = None

metadata = pd.DataFrame(np.empty(len(symbols), dtype=[

('start_date', 'datetime64[ns]'),

('end_date', 'datetime64[ns]'),

('auto_close_date', 'datetime64[ns]'),

('symbol', 'object'),

]))

def _pricing_iter():

sid = 0

with maybe_show_progress(

symbols,

show_progress,

label='Downloading Google pricing data: ') as it, \

requests.Session() as session:

for symbol in it:

path = _cachpath(symbol, 'ohlcv')

try:

df = cache[path]

except KeyError:

df = cache[path] = DataReader(

symbol,

'google',

start,

end,

session=session,

).sort_index()

# the start date is the date of the first trade and

# the end date is the date of the last trade

start_date = df.index[0]

end_date = df.index[-1]

# The auto_close date is the day after the last trade.

ac_date = end_date + pd.Timedelta(days=1)

metadata.iloc[sid] = start_date, end_date, ac_date, symbol

df.rename(

columns={

'Open': 'open',

'High': 'high',

'Low': 'low',

'Close': 'close',

'Volume': 'volume',

},

inplace=True,

)

yield sid, df

sid += 1

daily_bar_writer.write(_pricing_iter(), show_progress=True)

symbol_map = pd.Series(metadata.symbol.index, metadata.symbol)

asset_db_writer.write(equities=metadata)

adjustment_writer.write(splits=pd.DataFrame(), dividends=pd.DataFrame())

# adjustments = []

# with maybe_show_progress(

# symbols,

# show_progress,

# label='Downloading Google adjustment data: ') as it, \

# requests.Session() as session:

# for symbol in it:

# path = _cachpath(symbol, 'adjustment')

# try:

# df = cache[path]

# except KeyError:

# df = cache[path] = DataReader(

# symbol,

# 'google-actions',

# start,

# end,

# session=session,

# ).sort_index()

# df['sid'] = symbol_map[symbol]

# adjustments.append(df)

# adj_df = pd.concat(adjustments)

# adj_df.index.name = 'date'

# adj_df.reset_index(inplace=True)

# splits = adj_df[adj_df.action == 'SPLIT']

# splits = splits.rename(

# columns={'value': 'ratio', 'date': 'effective_date'},

# )

# splits.drop('action', axis=1, inplace=True)

# dividends = adj_df[adj_df.action == 'DIVIDEND']

# dividends = dividends.rename(

# columns={'value': 'amount', 'date': 'ex_date'},

# )

# dividends.drop('action', axis=1, inplace=True)

# # we do not have this data in the yahoo dataset

# dividends['record_date'] = pd.NaT

# dividends['declared_date'] = pd.NaT

# dividends['pay_date'] = pd.NaT

# adjustment_writer.write(splits=splits, dividends=dividends)

return ingest