The essence:

DAX is not the way to go. Use Home > Edit Queries and then Transform > Run R Script. Insert the following R snippet to run a regression analysis using all available variables in a table:

model <- lm(Manager ~ . , dataset)

df<- data.frame(coef(model))

names(df)[names(df)=="coef.model."] <- "coefficients"

df['variables'] <- row.names(df)

Edit Manager to any of the other available variable names to change the dependent variable.

The details:

Good question! Why Microsoft has not introduced more flexible solutions is beyond my understanding. But at the time being, you won't be able to find very good approaches without using R in Power BI.

My suggested approach will therefore ignore your request regarding:

The question is how can I get these values in Power BI using DAX

(preferably without having to write a custom R script)?

My answer will however meet your requirements regarding:

A good answer should generalize to more than 3 columns (probably by

working on an unpivoted data table with the indices as values rather

than column headers).

Here we go:

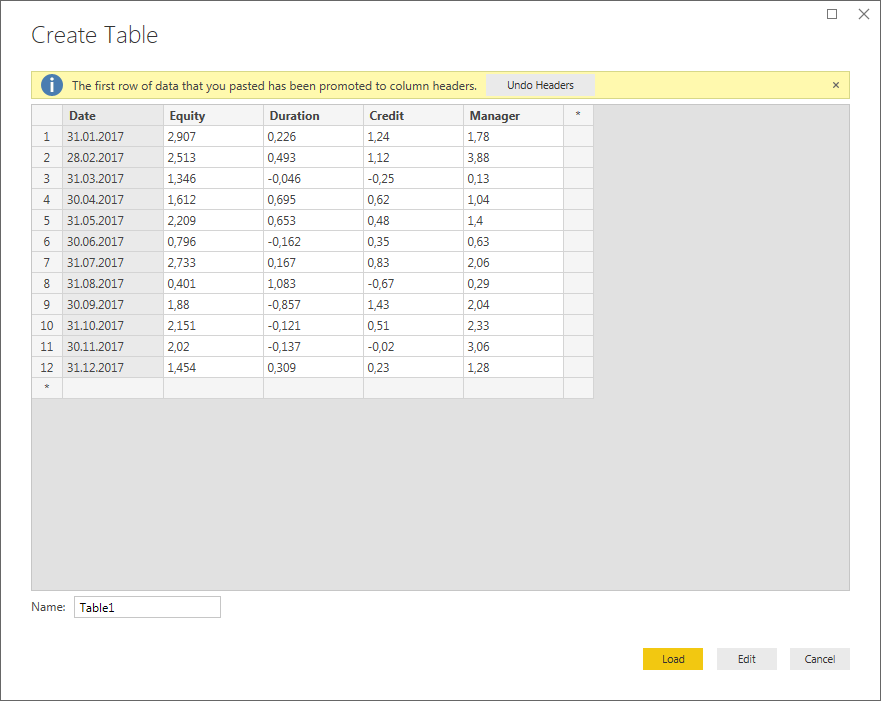

I'm on a system using comma as a decimal separator, so I'm going to be using the following as the data source (If you copy the numbers directly into Power BI, the column separation will not be maintained. If you first paste it into Excel, copy it again and THEN paste it into Power BI the columns will be fine):

Date Equity Duration Credit Manager

31.01.2017 2,907 0,226 1,24 1,78

28.02.2017 2,513 0,493 1,12 3,88

31.03.2017 1,346 -0,046 -0,25 0,13

30.04.2017 1,612 0,695 0,62 1,04

31.05.2017 2,209 0,653 0,48 1,4

30.06.2017 0,796 -0,162 0,35 0,63

31.07.2017 2,733 0,167 0,83 2,06

31.08.2017 0,401 1,083 -0,67 0,29

30.09.2017 1,88 -0,857 1,43 2,04

31.10.2017 2,151 -0,121 0,51 2,33

30.11.2017 2,02 -0,137 -0,02 3,06

31.12.2017 1,454 0,309 0,23 1,28

Starting from scratch in Power BI (for reproducibility purposes) I'm inserting the data using Enter Data:

![enter image description here]()

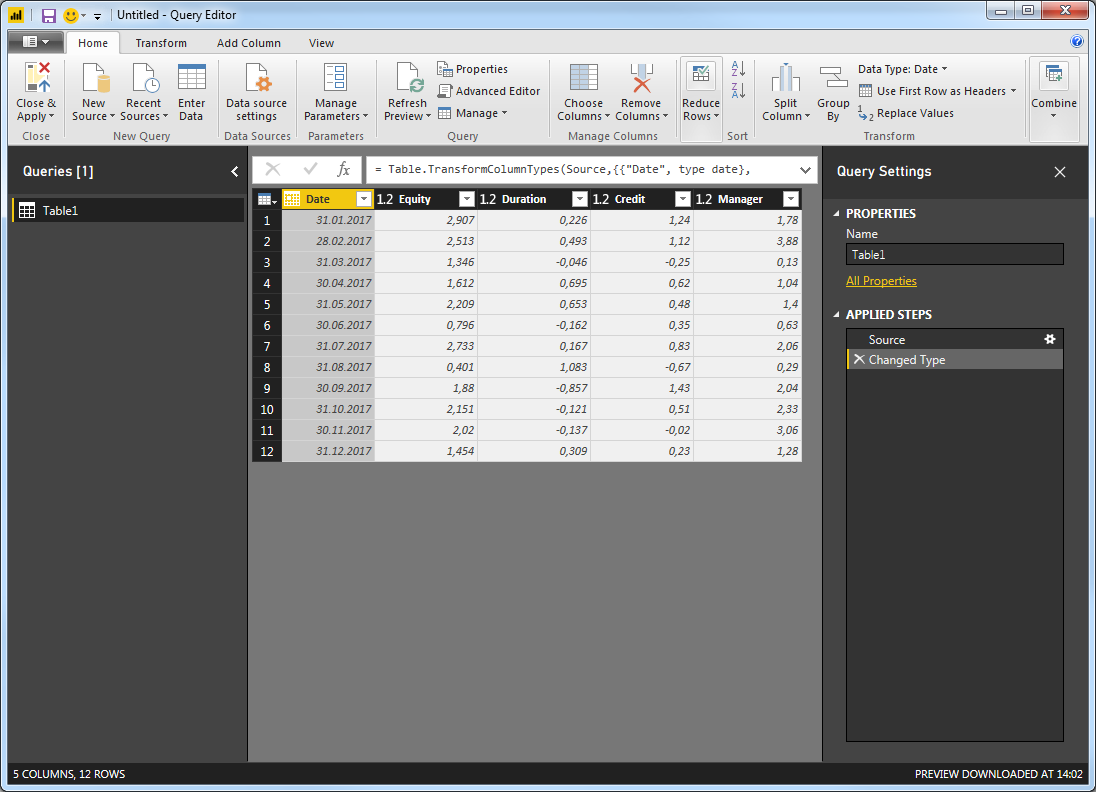

Now, go to Edit Queries > Edit Queries and check that you have this:

![enter image description here]()

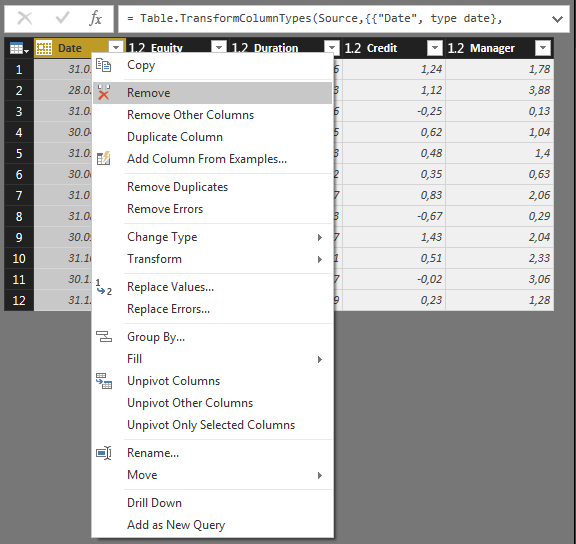

In order to maintain flexibility with regards to the number of columns to include in your analysis, I find it is best to remove the Date Column. This will not have an impact on your regression results. Simply right-click the Date column and select Remove:

![enter image description here]()

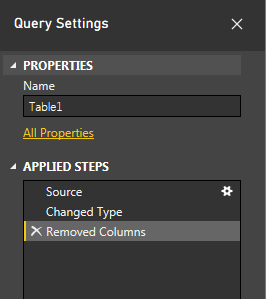

Notice that this will add a new step under Query Settings > Applied Steps>:

![enter image description here]()

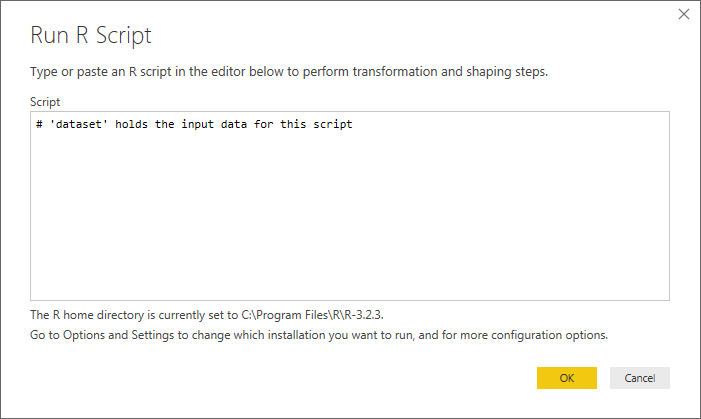

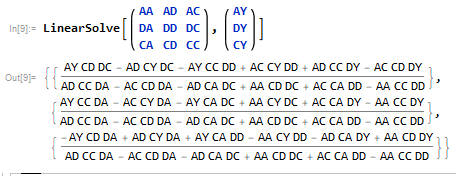

And this is where you are going to be able to edit the few lines of R code we're going to use. Now, go to Transform > Run R Script to open this window:

![enter image description here]()

Notice the line # 'dataset' holds the input data for this script. Thankfully, your question is only about ONE input table, so things aren't going to get too complicated (for multiple input tables check out this post). The dataset variable is a variable of the form data.frame in R and is a good (the only..) starting point for further analysis.

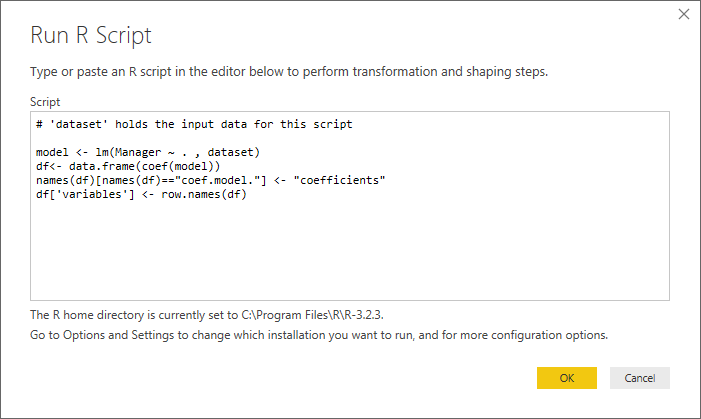

Insert the following script:

model <- lm(Manager ~ . , dataset)

df<- data.frame(coef(model))

names(df)[names(df)=="coef.model."] <- "coefficients"

df['variables'] <- row.names(df)

![enter image description here]()

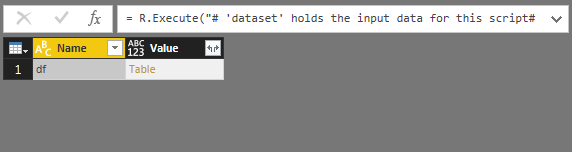

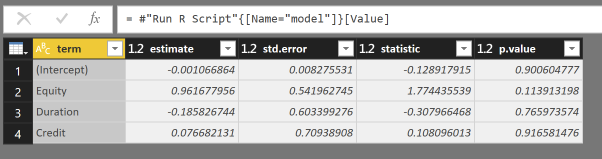

Click OK, and if all goes well you should end up with this:

![enter image description here]()

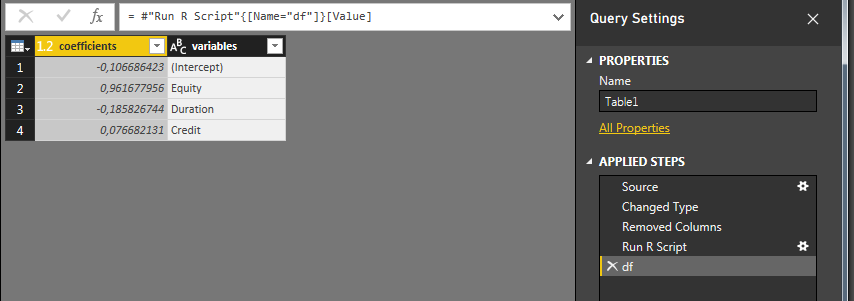

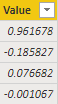

Click Table, and you'll get this:

![enter image description here]()

Under Applied Steps you'll se that a Run R Script step has been inserted. Click the star (gear ?) on the right to edit it, or click on df to format the output table.

This is it! For the Edit Queries part at least.

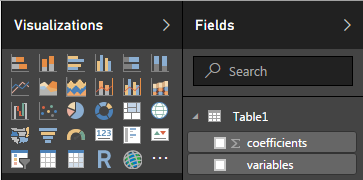

Click Home > Close & Apply to get back to Power BI Report section and verfiy that you have a new table under Visualizations > Fields:

![enter image description here]()

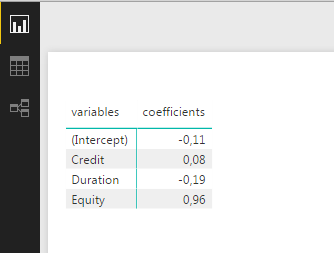

Insert a Table or Matrix and activate Coefficients and Variables to get this:

![enter image description here]()

I hope this is what you were looking for!

Now for some details about the R script:

As long as it's possible, I would avoid using numerous different R libraries. This way you'll reduce the risk of dependency issues.

The function lm() handles the regression analysis. The key to obtain the required flexibilty with regards to the number of explanatory variables lies in the Manager ~ . , dataset part. This simply says to run a regression analysis on the Manager variable in the dataframe dataset, and use all remaining columns ~ . as explanatory variables. The coef(model) part extracts the coefficient values from the estimated model. The result is a dataframe with the variable names as row names. The last line simply adds these names to the dataframe itself.