I found the easiest to be the new SimFin Python API which lets you download stock-prices and fundamental data, save it to disk, and load it into Pandas DataFrames with only a few lines of code. They have also made several tutorials on how to use their data with other libraries such as statsmodels, scikit-learn, TensorFlow, etc. The basic example below is copied from their github page.

You install the SimFin python package by typing this command in a terminal window (preferably in its own environement, see their full instructions):

pip install simfin

Then you copy-paste the following into a Jupyter Notebook or Python source-file:

import simfin as sf

from simfin.names import *

# Set your API-key for downloading data.

# If the API-key is 'free' then you will get the free data,

# otherwise you will get the data you have paid for.

# See www.simfin.com for what data is free and how to buy more.

sf.set_api_key('free')

# Set the local directory where data-files are stored.

# The dir will be created if it does not already exist.

sf.set_data_dir('~/simfin_data/')

# Load the annual Income Statements for all companies in USA.

# The data is automatically downloaded if you don't have it already.

df = sf.load_income(variant='annual', market='us')

# Print all Revenue and Net Income for Microsoft (ticker MSFT).

print(df.loc['MSFT', [REVENUE, NET_INCOME]])

This produces the following output:

Revenue Net Income

Report Date

2008-06-30 6.042000e+10 17681000000

2009-06-30 5.843700e+10 14569000000

2010-06-30 6.248400e+10 18760000000

2011-06-30 6.994300e+10 23150000000

2012-06-30 7.372300e+10 16978000000

2013-06-30 7.784900e+10 21863000000

2014-06-30 8.683300e+10 22074000000

2015-06-30 9.358000e+10 12193000000

2016-06-30 9.115400e+10 20539000000

2017-06-30 9.657100e+10 25489000000

2018-06-30 1.103600e+11 16571000000

2019-06-30 1.258430e+11 39240000000

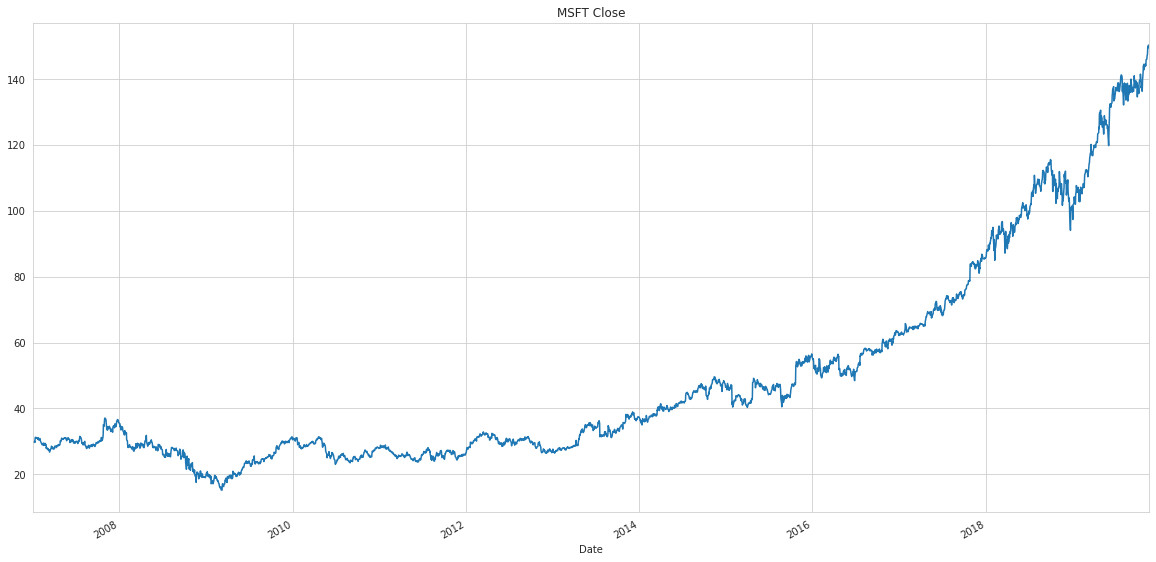

We can also load the daily share-prices and plot the closing share-price for Microsoft (ticker MSFT):

# Load daily share-prices for all companies in USA.

# The data is automatically downloaded if you don't have it already.

df_prices = sf.load_shareprices(market='us', variant='daily')

# Plot the closing share-prices for ticker MSFT.

df_prices.loc['MSFT', CLOSE].plot(grid=True, figsize=(20,10), title='MSFT Close')

This produces the following image:

![MSFT Share-Price Close]()

a = [float(f.close_price.values[i].encode('ascii')) for i in range(len(f.close_price.values))] f = pd.Series(a, f.begins_at.values)# morningstar discontinued --> change to robinhood – Runagate